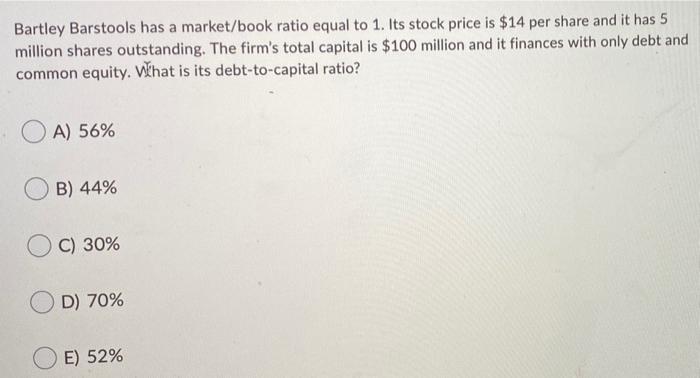

SOLVED: Bartley barstools has a market/book ratio equal to 1. Its stock price is 14 per share, and it has 5 million shares outstanding. The firm's total capital is125 million, and it

FIN 3331 Homework 2.docx - Hannah Chan 1505763 Homework Two: Chapter 4 4-1. DAYS SALES OUTSTANDING: Baker Brothers has a DSO of 40 days and its annual | Course Hero

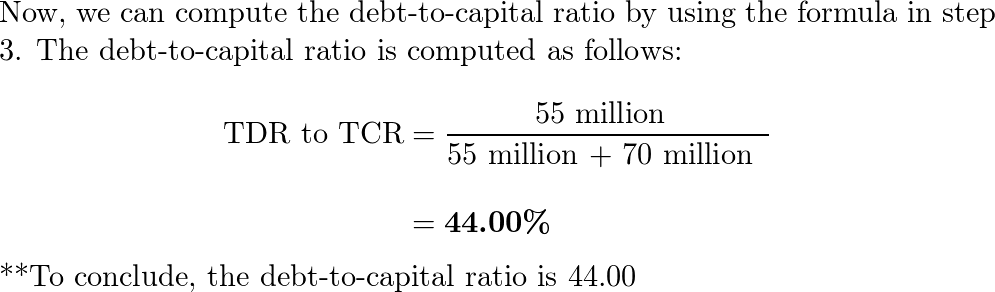

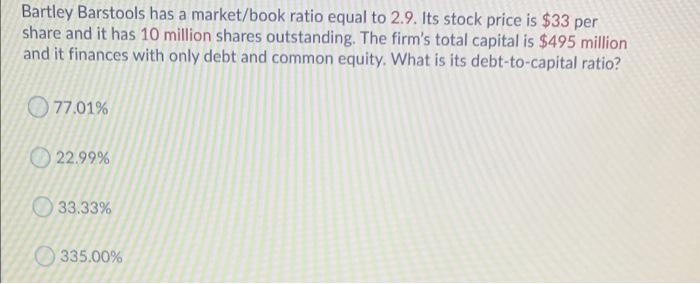

SOLVED: Bartley barstools has a market/book ratio equal to 1. Its stock price is 14 per share, and it has 5 million shares outstanding. The firm's total capital is125 million, and it

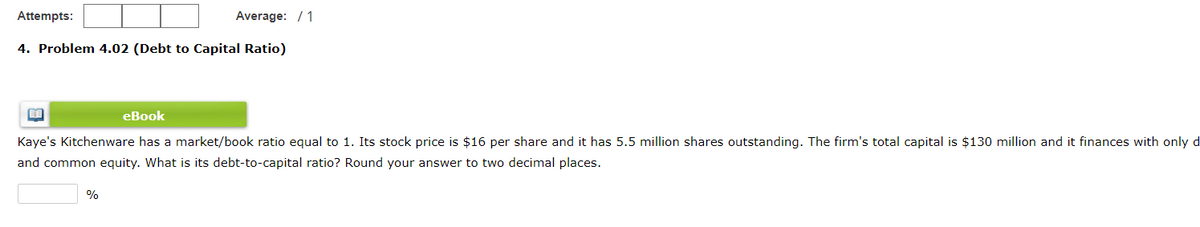

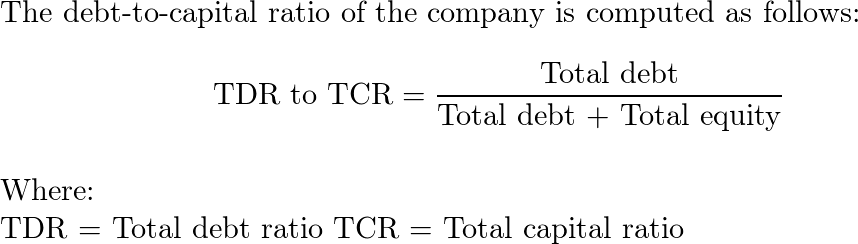

Kaye's Kitchenware has a market/book ratio equal to 1. Its stock price is $14 per share and it has 5.1 million shares outstanding. The firm's total capital is $125 million and it

SOLUTION: Bartley Barstools has an equity multiplier of 2.4 and its assets are financed with some combination of long-term debt and common equity What is its equity ratio? What is its debt

SOLUTION: Bartley Barstools has an equity multiplier of 2.4 and its assets are financed with some combination of long-term debt and common equity What is its equity ratio? What is its debt

FIN assignment 3.docx - Students Name: Thao Thach Tran ID:1490321 FIN 3331 ASSIGNMENT 3 4-1 DAYS SALES OUTSTANDING Baker Brothers has a DSO of 40 days | Course Hero

FIN CHAP 03 SOLUTIONS - CHAPTER 3 3-1 DAYS SALES OUTSTANDING Baker Brothers has a DSO of 40 days. The company's annual sales are $7 300 000. Assume | Course Hero